In an increasingly complex regulatory and fiscal landscape, yacht owners and their advisers are looking for stable, well-regulated jurisdictions that offer clarity, flexibility, and efficiency. The Isle of Man has long been a respected centre for yacht ownership and management, and it continues to offer advantages for those involved in both private and commercial yachting.

In the Private Yachting space the Island facilitates access to Customs reliefs such as Temporary Admission for privately used yachts, provided specific criteria are met.

In this article we cover the following topics to provide a quick overview:

- Temporary Admission Relief (TAR) for Private Yachts

- How to Meet the Requirements of Temporary Admission Relief (TAR)

- What Next? Things to Consider When Planning Your Yacht Fiduciary Services

- What are Your Yacht Fiduciary Service Options? Jurisdictions & Providers

Temporary Admission Relief (TAR) for Private Yachts

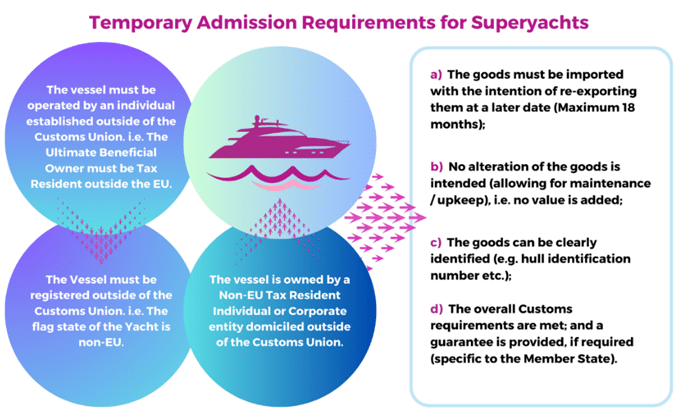

Temporary Admission Relief (TAR) is a Customs procedure which allows certain goods (including means of transport – e.g., private Yachts) to be brought into the Customs Territory with total or partial relief from import duties and taxes, subject to conditions.

For example, the goods must be imported for ‘Specific Purpose’ and are intended for re-exportation within a specified period.

Whilst owners established outside of the Customs area are exempt from VAT under TAR, Customs Duty relief varies, dependent on the jurisdiction’s classification of the vessel and its Specific Purpose for being imported.

For quick reference we have provided a table of the headline details/requirements below:

| EU TAR |

| The Vessel is registered outside of the Customs Union. (The flag state of the Yacht is non-EU) |

| The vessel is used by an individual established outside of the Customs Union. (The owning entity is established outside the EU) |

| The vessel must be operated by an individual established outside of the Customs Union. (Ultimate Beneficial Owner must be resident outside the EU) |

| Some further conditions to note: a. The goods must be imported with the intention of re-exporting them at a later date (Maximum 18 months); b. No alteration of the goods is intended (allowing for maintenance/upkeep), i.e. no value is to be added; c. The goods can be clearly identified (e.g., hull identification number etc.); d. The overall Customs requirements are met; and e. A guarantee is provided, if required (specific to the Member State). |

How to Meet the Requirements of Temporary Admission Relief (TAR)

Thankfully there is a lot of scope for meeting the requirements for those wishing to set sail in the EU under TA:

- Registration of the Vessel

For a TA procedure to apply with full VAT and Customs Duty relief, the Yacht must be registered in a jurisdiction outside of the EU (it will use the flag of a Non-Member State).

Following its departure from the EU, the Isle of Man now meets this criteria, alongside traditional favourites such as the Cayman Islands.

- Establishment of the Individual

For our purposes, ‘individual’ refers to both Natural Persons and Corporate Entities. In this way we can have an individual established in a separate jurisdiction to the Ultimate Beneficial Owner (UBO) – often by way of a holding company, that will own the Yacht and which in turn will be subject to the local tax regime.

The jurisdiction of establishment in this case does not necessarily have to be the same as the chosen flag of the vessel.

- Establishment of the Ultimate Beneficial Owner (UBO)

For the purposes of TA, so long as the UBO is resident outside of the EU, they will qualify.

What Next? Things to Consider When Planning Your Yacht Fiduciary Services

When selecting a suitable ownership structure for the registration of a Private Yacht, which will benefit from TAR within EU waters, we would suggest checking the following broad criteria.

Choosing a Jurisdiction for the Holding Structure

- Strong economic international standards – a minimum ‘A rating’. (S&P / Moody’s)

- Robust legal standards.

- An OECD Whitelisted jurisdiction with a strong reputation for compliance and transparency.

- Beneficial tax regime taxes.

Choosing a Yacht Fiduciary Service

To assist with the specialist advice, corporate structuring, and administration of the Yacht, we would recommend ensuring that your service provider ticks the following boxes:

- Geographic location – with relation to the local tax regime and time zone (for accessibility and ease of dealing).

- A proven track record –how established the provider is in the sector, as well as familiarity with this category of service.

- Access to experts – with many providers, their scale often prevents direct and regular dealings with senior qualified staff members; you will want access to experts whenever you have a query or action that is required, and not to always have these dealt with by juniors.

- Your business is valued – in an ideal situation, your business will be a priority to the provider, not just another client on the books. Finding a provider that is adaptable and responsive is key to service excellence.

What are Your Yacht Fiduciary Service Options?

With so many well-established shipping registrars and a wide selection of beneficial jurisdictions for incorporating a holding structure, you would be forgiven for having flashbacks of 2020’s uncertainty. This is where we can help.

At Dixcart, your needs are our priority – we provide a bespoke and personal service for those looking to manage and administer their luxury assets; giving you access to experts as and when you require them.

Because we are based in the Isle of Man, we benefit from our Aa3 rated jurisdiction’s political, economic and environmental stability. The Island is a self-governed Crown Dependency, setting its own laws and rates of taxation.

Whilst we can access any number of shipping registers, our local registrar has an exceptional track record of service excellence; providing an approach that blends modern flexible services and competitive rates without compromising on quality.

The beneficial tax regime, business friendly government and OECD ‘Whitelist’ status ensure that the tax vehicles we offer can help you achieve your goals whilst remaining globally compliant.

An Isle of Man registered Company enjoys the following benefits:

- No capital gains taxes

- No stamp duty (including on share transfers)

- No inheritance tax or death duties

We have been assisting clients and their advisers for over 45 years with the effective structuring and administration of wealth, having experience of utilising multiple shipping registers to ensign vessels in line with their desired purpose. If you would like to discuss how we can assist you in achieving the effective and efficient administration of a vessel we would be delighted to hear from you. Please contact Paul Harvey at the Dixcart Office in the Isle of Man: advice.iom@dixcart.com.

Alternatively, you can connect with Paul on LinkedIn or find out more about our Dixcart Air Marine services here.

Dixcart Management (IOM) Limited is licensed by the Isle of Man Financial Services Authority.

This information is provided as guidance and should not be considered advice. The most appropriate vehicle is determined by individual client needs and specific advice should be sought.