Extension of the Ability to Use a Cell Company in Malta

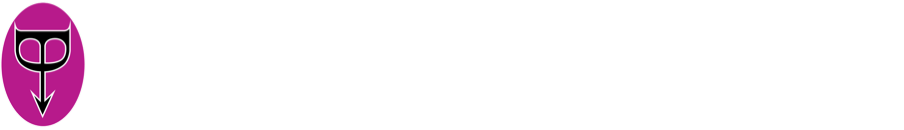

Shipping and Aviation Cell Company Regulations were issued in Malta, earlier this year. The purpose of these regulations is to provide the opportunity to use a new cell structure for companies operating in the fields of shipping and aviation.

Cell companies, for use in the insurance and securitisation sectors, have already been successfully established in Malta, under the Companies Act for Cell Companies. It was felt beneficial to extend this type of corporate structure to the shipping and aviation industry.

Benefits Cell Companies Offer

The definition of a cell, within the relevant Malta Companies Act, summarises the benefits available; a cell company creates ‘within itself one or more cells for the purpose of segregating and protecting the cellular assets of the company in such a manner as may be prescribed’.

Each cell is treated as a separate legal entity which allows for the segregation of assets and liabilities relevant to the individual cell, from the assets and liabilities of the non-cellular element, and from the other cells.

A cell company may have more than one cell and each cell is treated independently from any other cell forming part of the same cell company. A cell company therefore provides protection for cells, from the other cells within the same company.

Obligations Cell Companies Must Meet

Cell Companies are distinguished from other companies by their name, which must include the words; ‘Mobile Assets Protected Cell Company’ or ‘MAPCC’.

Companies with such a structure may be formed or constituted as a cell company to conduct shipping or aviation business. Alternatively, a company conducting such business can be converted into a cell company, if permitted to do so by its memorandum and articles of association.

The assets of a cell company can be cellular or non-cellular assets. Such assets consist of the cell’s capital and reserves, as well as all other assets attributable to the different cells.

A cell company may, in respect of any of its cells, create and issue shares, these are known as ‘cell shares’. The proceeds of the issue of this ‘cell share capital,’ will form the assets of the cell.

Cell companies must inform all third parties that they are dealing with a cell company, and that there are two regulations which specifically deal with creditors and the recourse available for creditors in relation to cellular assets.

Examples – How Aviation and Shipping Companies Can Use a Cell Company

There are numerous examples of how a cell company can be effectively used to segregate assets in the fields of aviation, shipping and yachting:

- In relation to aviation, for example; one cell could own the plane, the second cell the engine, the third cell ‘aircraft management’ and a fourth cell might relate to the employees’ pension fund.

- A similar, relatively simple example in relation to yachting, might be where one cell owns yacht A, the second cell owns yacht B, the third cell owns yacht C, and cell D owns the business matters in relation to ‘yacht management’.

Additional Information

If you would like further information regarding Malta Cell Companies and the opportunities that they provide and/or the registration of a ship, yacht or aircraft in Malta, please contact Jonathan Vassallo at the Dixcart office in Malta at advice.malta@dixcart.com.